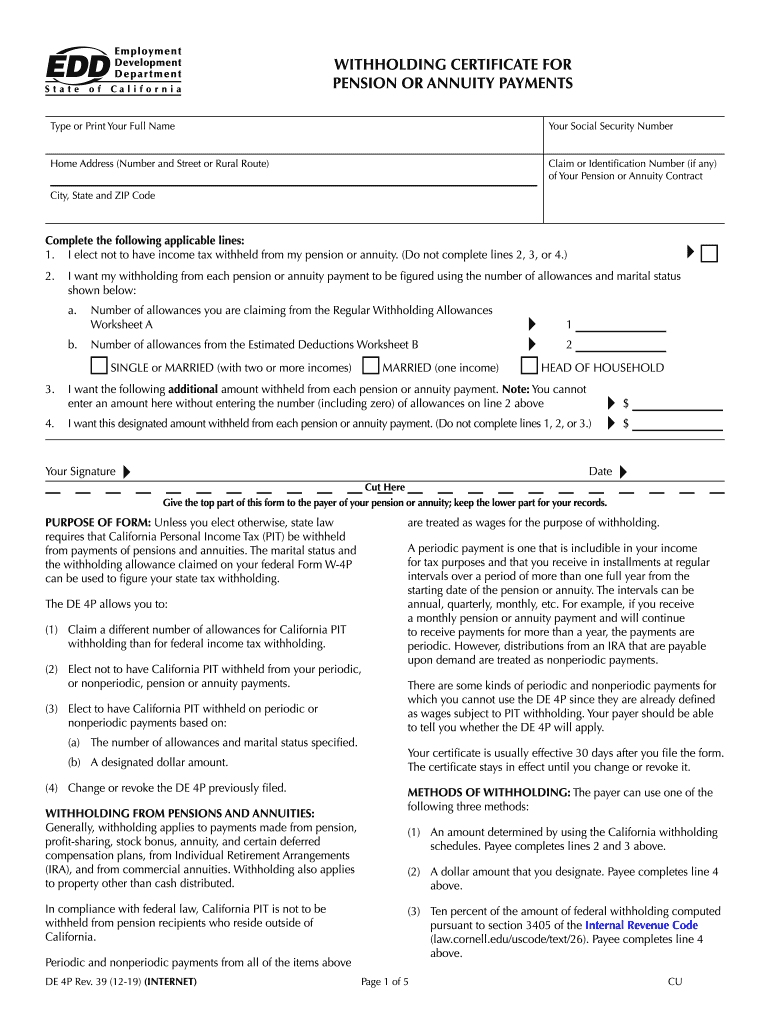

2024 Edd Withholding Form. The sdi rate for 2024 is 1.1%, for more information visit rates and. The california employment development department (edd) has released the 2024 voluntary plan employee contribution and benefit rate.

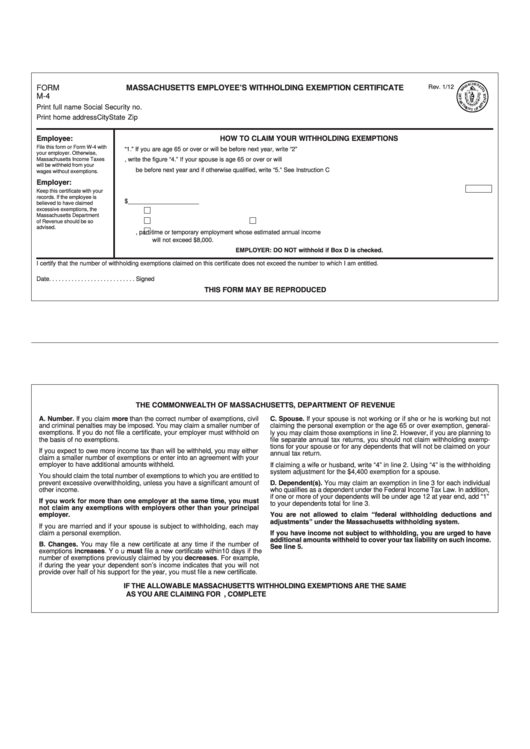

This option will not electronically file your form. Only need to adjust your state withholding allowance, go to the employment development department (edd) website and get form de 4, employee’s withholding allowance.

Form Used By Recipients Of Annuity, Sick Pay Or Retirement.

Complete if your company is making required withholding payments on behalf of your company’s employees on a monthly.

Under Irs Rules, Taxable Benefits Include Unemployment Benefits,.

2024 city income tax withholding monthly return.

The California Employment Development Department (Edd) Has Released The 2024 Voluntary Plan Employee Contribution And Benefit Rate.

Images References :

Source: www.withholdingform.com

Source: www.withholdingform.com

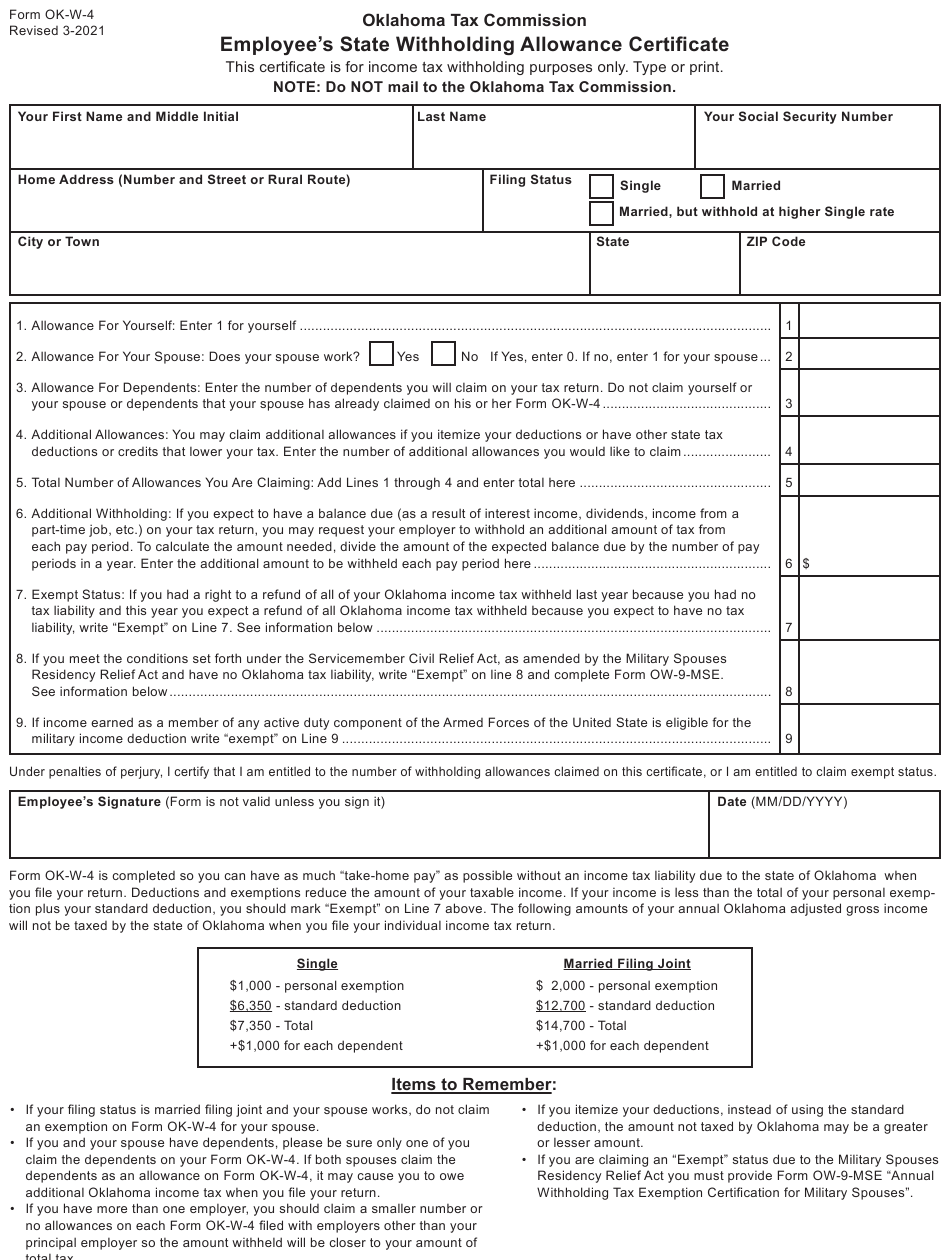

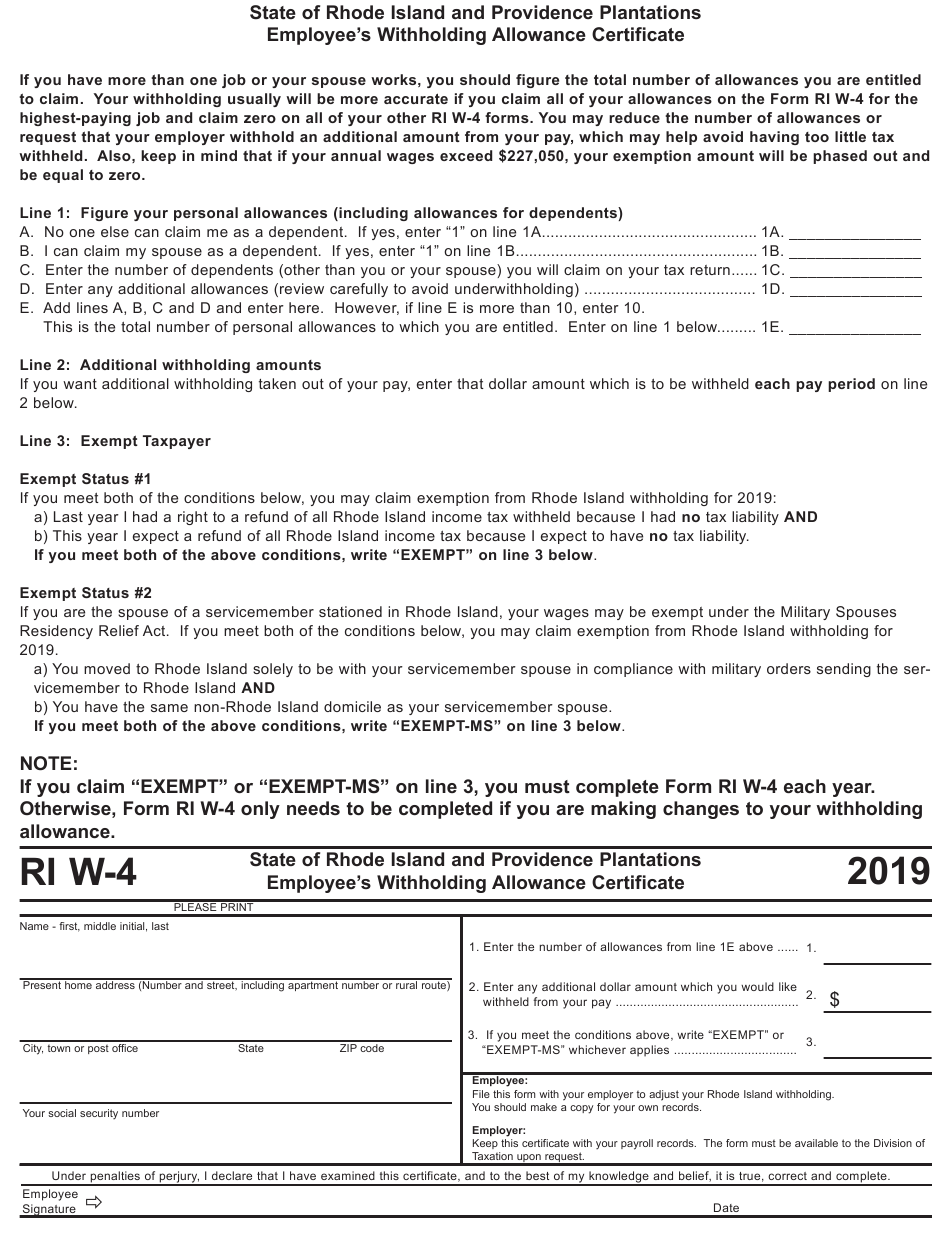

Edd Employee Withholding Form, The de 4 form, or employee’s withholding allowance certificate, is used by california employees to determine the number of withholding allowances they claim for. Complete if your company is making required withholding payments on behalf of your company’s employees on a monthly.

Source: ronicawcecile.pages.dev

Source: ronicawcecile.pages.dev

Va Withholding Form 2024 Dayle Erminie, Do i need to fill out a de 4? Under irs rules, taxable benefits include unemployment benefits,.

Source: www.withholdingform.com

Source: www.withholdingform.com

Employee Tax Withholding Form Edd, Copy and distribute this form from the edd to employees so they can determine their withholding allowances. The edd sends this form to a person’s last employer when a new claim is filed, or an existing claim is reopened.

Source: oforms.onlyoffice.com

Source: oforms.onlyoffice.com

Form W4 (Employee's Withholding Certificate) template, The edd form de 4 lets employees claim withholding allowances according to their filing status, number of dependents, and deductions. Do i need to fill out a de 4?

Source: printablew9.com

Source: printablew9.com

W9 Federal Withholding Form Printable W9 Form 2023 (Updated Version), 2024 city income tax withholding monthly return. Under irs rules, taxable benefits include unemployment benefits,.

Source: www.employeeform.net

Source: www.employeeform.net

Md Employee Withholding Form 2022 2023, Form used to apply for a refund of the amount of tax withheld on the. 2024 city income tax withholding monthly return.

Source: www.employeeform.net

Source: www.employeeform.net

Oklahoma Employee Withholding Form 2023, Copy and distribute this form from the edd to employees so they can determine their withholding allowances. The edd sends this form to a person’s last employer when a new claim is filed, or an existing claim is reopened.

Source: www.taxuni.com

Source: www.taxuni.com

Federal Withholding Tables 2024 Federal Tax, 2024 city income tax withholding monthly return. Application for tentative refund of withholding on 2024 sales of real property by nonresidents.

Source: www.signnow.com

Source: www.signnow.com

De 4p Form Complete with ease airSlate SignNow, How to complete the california edd de 4 form [2024] taxes. Copy and distribute this form from the edd to employees so they can determine their withholding allowances.

Source: jacindawlani.pages.dev

Source: jacindawlani.pages.dev

Irs Form W4 2024 Printable Nadya Valaria, 2024 city income tax withholding monthly return. Effective january 1, 2024, senate bill (sb) 951 removes the taxable wage limit and maximum withholdings for each employee subject to state disability insurance (sdi) contributions.

Effective January 1, 2024, Senate Bill (Sb) 951 Removes The Taxable Wage Limit And Maximum Withholdings For Each Employee Subject To State Disability Insurance (Sdi) Contributions.

Copy and distribute this form from the edd to employees so they can determine their withholding allowances.

Form Used To Apply For A Refund Of The Amount Of Tax Withheld On The.

This form allows each employee to claim allowances or an exemption to montana wage withholding when applicable.